Get a nice, chunky isa

If you put up to £20,000 into a stocks and shares ISA by the end of the 2020/21 tax year – which ends on Monday, 5 April 2021 – any gains you make are free from UK capital gains and income tax.

You have until 5pm on Thursday, 1 April to put money into your Coutts ISA and benefit from the 2020/21 ISA allowance.

Tax reliefs referred to are those applying under current legislation which may change. The availability and value of any tax reliefs will depend on your individual circumstances.

Get a nice, chunky isa

If you put up to £20,000 into a stocks and shares ISA by the end of the 2020/21 tax year – which ends on Monday, 5 April 2021 – any gains you make are free from UK capital gains and income tax.

You have until 5pm on Thursday, 1 April to put money into your Coutts ISA and benefit from the 2020/21 ISA allowance.

Tax reliefs referred to are those applying under current legislation which may change. The availability and value of any tax reliefs will depend on your individual circumstances.

QUICK AND EASY

An ISA is really simple to set up at Coutts. You don’t need to slog through a plethora of forms and spend hours sorting it out. It just involves making a few decisions and clicking a few links. Find out more.

The value of investments, and the income from them, can go down as well as up, and you may not recover the amount of your original investment.

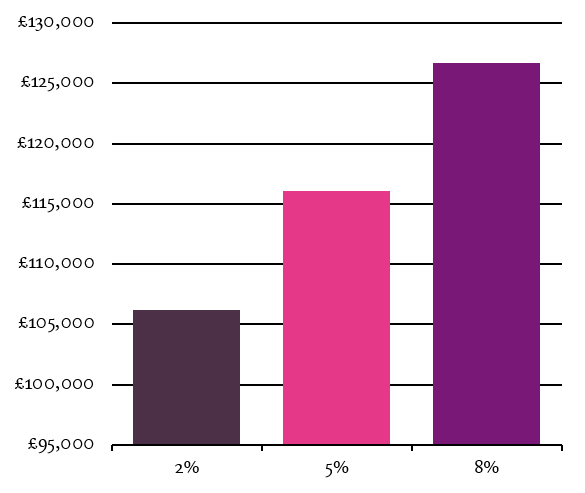

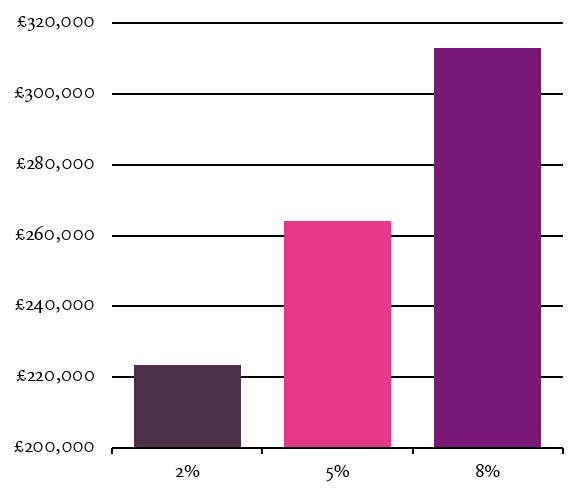

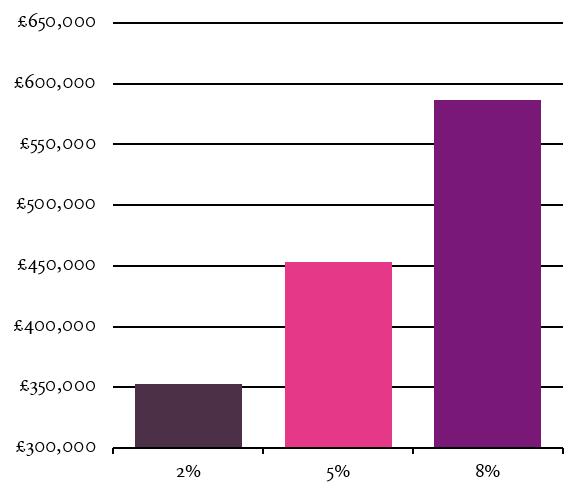

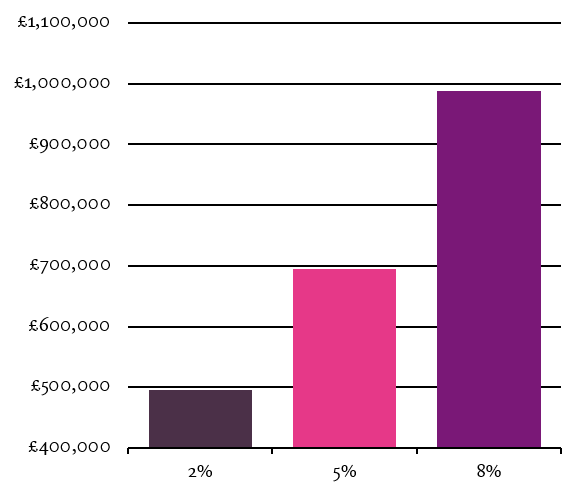

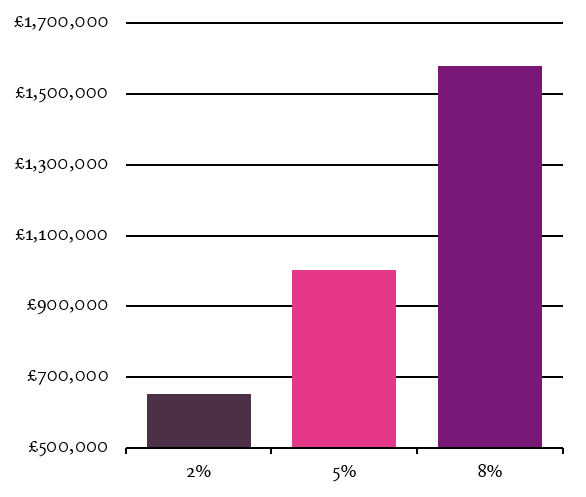

How your wealth could grow

Investing in a stocks and shares ISA could potentially see your wealth grow considerably over time. Choose a holding period below and see.

Source: Coutts & Co 2021

For illustrative purposes only. This is an example only and does not represent a typical or likely outcome.

Assumptions made are that the growth rates used are not representative of any investment instrument and that it does not change during the term of the investment shown. This is an unlikely outcome as the value of investments can go down as well as up and you may get back less than you invest. The terms used are to demonstrate the medium to long-term nature of investing. This example does not take into account commission, fees or charges which will reduce the returns shown above. It is assumed £20,000 is invested each year and no additional investments or withdrawals have been made during the term.

The tax treatment of the investment is that applying under current legislation and can change. The availability and value of any tax reliefs will depend on your individual circumstances.

Coutts Invest is available to clients who are UK resident and domiciled for tax purposes, aged 18 or over, use Coutts Online and have a minimum of five years to invest.

If you’re over 74, or are UK resident but non-domiciled for tax purposes, speak to your private banker who can organise access for you.

Fees and charges apply.

Five reasons to get an ISA

Already a client?

For more information about our services, please speak to your adviser or call 020 7957 2424.

Already a client?

For more information about our services, please speak to your adviser or call 020 7957 2424.

Become a client

Please get in touch online or call 020 7753 1365 to find out more about our services.

Calls may be recorded.